Posts Tagged ‘infographic’

Counterfeit Cash – Fake Money: Stats Infographic

on Saturday, June 9, 2012

“Men make counterfeit money; in many more cases, money makes counterfeit men” — Sydney J. Harris

“If you’re working for a bank, you don’t study the counterfeit to know the real thing. You study the real thing to know the counterfeit” — Charles Martin

by Iron FX No Derivatives Attribution 2.0 Learn More about IronFx

COUNTERFEIT CURRENCY:

What is the price of free money? We all spend much of our lives handling money. In fact, cash is so commonplace to us that we often scarcely pay any attention to it all. Look a little closer, and you’ll soon appreciate how big of an issue currency counterfeiting is. Criminals stand to make millions, and governments invest even more than that to make their money as hard to fake as possible.

Fraud Fighting Origins

At the end of the American Civil War, 1/3 of all American currency was counterfeit. There were 1600 different state banks designing and printing 7000 varieties of genuine notes, and 4000 varieties of counterfeits being produced. This situation led Abraham Lincoln to establish the United States Secret Service to combat counterfeiting.

The State of the Nations

America in 2011 3,028 people arrested for counterfeiting US currency. $261 million dollars in counterfeit cash is removed from circulation. US Population 311 million equals approximately 84 cents for every man, woman and child in the country. As much as $220 million counterfeit cash could currently be in circulation (about $3. for every $10,000).

North Korea is thought to be responsible for producing $45 million in ‘Supernotes’, and is estimated to have earned $15-25 million a year from this counterfeiting. A ‘supernote is a counterfeit US $100 of very high quality containing many of the proper security features found in genuine bills. North Korea has a population of about 24 thus its output of $45 million US per year Is roughly $1.87 per person.

In 2002 $121.8 million dollars were intercepted outside of the US. By contrast, in the same year, only $52.6 million was intercepted domestically.

- Canada In 2007, $3,333,170 were passed, which is 10 cents per person.

- United KingdomIn the UK in 2010, 300,000 counterfeit notes were removed from circulation, That’s worth about £5.9 million ($9.76 million). That’s about 14 cents per person.

- Europe 19.9 million Euros ($27.6 million) removed from circulation in 2009. That’s about 8 cents per person.

Counterfeiting Trends

Florida In South Florida in 2011, law enforcement officials track between $60,000 and $80,000 a week in counterfeit bills. That is, on average $3,640,000 a year. With a population of 4.32 million. that works out as around 84 cents for everyone man woman and child. In Central Florida. some $20,000 is removed weekly. That works out as $1,040,000 a year.

Missouri In Kansas City, Missouri, $300,000 in fake bills is removed each year.

Canada: In Canada, Quebec and Ontario are the two biggest provinces for counterfeiting.

Quebec In Quebec in 2007, 55,480 counterfeit notes were passed, while 5,572 were seized before entering circulation.

Ontario In Ontario in 2007, 53,329 counterfeit notes were passed, while 14,933 were seized before entering circulation.

Arrests Made For Counterfeiting US Money:

- 2007: 2,205

- 2008: 2,493

- 2009: 2,946

- 2011: 3,028

Counterfeit Money Removed Per Year:

USA

- 2005: $61 Million

- 2006: $62 Million

- 2008: $103 Million

- 2009: $132 Million

- 2011: $261 Million

EUROPE

- 2005: €525,000

- 2006: €562,500

- 2007: €562,500

- 2008: €660,000

- 2009: €850,000

Share of total counterfeit stock by individual denominations: (US 2002)

- $1 $0.01 Million – 0.097%

- $5 $0.04 Million – 0.388%

- $10 $0.17 Million – 1.649%

- $20 $0.49 Million – 4.75%

- $50 $0.30 Million – 2.9%

- $100 – $90.2 Million – 90.2%

Notes Removed From Circulation:

United Kingdom 2010:

- £5 = 2% (6,000)

- £10 = 3.66% (11,000)

- £20 = 93.3% (280,000)

- £50 = 1% (3,000)

- £5.9 million ($9.76 million) 47% reduction from 2009

-

1.501 billion pound coins in circulation, of which 2.94% (£44.13 million/$70.1 million) are estimated to be counterfeit.

Canada 2007:

- $5 = 12% (16,382)

- $10 = 10% (13,791)

- $20 = 66% (94,145)

- $50 = 7% (10,263)

- $100 = 5% (7,003)

- $1,000 = 0% (17)

Ink-jet Counterfeits

In 1995, less than 1% of US counterfeits came from ink-jet printers. Between October 2007 and August 2008, ink-jet counterfeits accounted for 60% of US counterfeiting output.

Counterfeit Production Costs $100 = $50 It can cost more than $50 to produce and distribute each high-quality counterfeit $100 bill

Counterfeiting Countermeasures

- Very Fine Lines – Very fine lines are visible on very close inspection, which will not be present in fakes.

- Mircoprint – Text is “microprinted” onto the bill. This is hard to reproduce without high quality printing equipment.

- Color Shift – Color shifting inks are used which cause the note’s colors to change when tilted.

- Threads – Bills are printed with a security thread which is embedded in the bill rather than printed on it. The threads are clearly visible when the bill is held up to the light. with ‘USA’ and the denomination of the bill written on them. The threads also glow blue when held under a UV light.

- Paper – American currency is printed on paper that is 1/4 linen and 3/4 cotton, and has red and blue fibres mixed into it. The supply of the paper is strictly controlled, making it almost impossible to obtain outside of the government.

- Watermarks – Watermarks are visible when the note is held up to the light.

Counterfeiting Culprits

- Jonathan Reyes, arrested at JFK airport with $190,000 worth of fake $100 bills.

- Stephen Jory, British counterfeiter, confessed to a charge of producing at least £50 million ($79.5 million) in £20 notes. He also made £300 million as a sideline in fake perfume.

- Alves Dos Reis, a Portuguese career criminal, was found to have spent 200,000 500 escudo notes worth around $1,599,891. This was equivalent to 0.88% of Portugals nominal GDP at the time.

- Anatasios Arnaouti was convicted and jailed in 2005 for counterfeiting £2.5 million in fake £10 Notes and $3.5 million in fake $100 bills.

Wartime Counterfeiting

- English American Dollars During the American revolution, the British government flooded America with counterfeit continental dollars in order to destabilize the currency.

- American Dollars During the American civil war, Samuel C. Upham sold more than 80,000 fake confederate notes, worth $15 million. That’s a total of 2.78% of the confederate money stock.

- German English Pounds In 1942, the Nazis established a plan (Operation Bernhard) to collapse the British cconomy by flooding it with counterfeit money. They used forced Jewish labour to produce counterfeits almost indistinguishable from the real thing.

BY APRIL 1945 – 8,965,080 COUNTERFEIT NOTES PRODUCED = £134,610,810 TOTAL VALUE

However, the war was over too soon for the Nazi plan to be pur into action, and most of the counterfeit notes were thought to have ended up at the bottom of Lake Toplitz.

Counterfeiters vs Other Con-men

- COUNTERFEIT MONEY – $220 Million in counterfeit currency could be in circulation.

- SCAMS & FRAUD – $830 Million loss caused by 419 scams (a.k.a. Nigerian advance fee fraud) in 2007.

- FAKE CHECKS – $1.024 estimated loss resulting from $760,955 check frauds in 2008.

- CARD FRAUD – per year in payment card fraud.

- IDENTITY FRAUD – $2.73 Billion loss as a result of identity fraud in 2008. 8.1 million adults in the US were victims of identity fraud, with an average of $4,607 per victim.

- COUNTERFEIT GOODS – to $250 billion per year the market for counterfeit goods (claimed by the chamber of commerce).

China has seen a spike in counterfeit activity and is introducing a new 100 Yuan Note to buck the trend. See the Wall Street Journal report from “China Real Time” blog. Here’s the new ¥ 100 Note:

Don’t Overlook Tax Deductions

on Tuesday, April 17, 2012 Average Time Required for Filing Your Taxes

• Form 1040 • Form 1040A • Form 1040EZ

Estimated time needed for completing and submitting Tax Form 1040 without Professional Tax Preparer 22 hours, including

- Record Keeping

- Tax Planning

- Form Completion

- Form Submission

$290 average out-of-pocket costs for tax preparation and submission of Tax Form 1040 without a Professional Tax Preparer

You May Want To Hire A Tax Professional If You:

- Own a business

- Have rental properties

- Have complicated stock transactions

- Filed for divorce

- Sold property

- Have employee stock options

- Have cancellation of debt issues

- Filed for bankruptcy

- Received a major gift or prize

- Are generally confused

Average Tax Professional Fees For 2011 Tax Season:

- $233 For an itemized Form 1040 and State Return

- $128 For Form 1040 without itemized deductions and State Return

COMMONLY MISSED DEDUCTIONS

Another important reason to hire a tax professional is to catch errors

and keep from missing deductions before you file. The following are

six commonly missed deductions.

CHARITABLE NONCASH CONTRIBUTIONS

- includes old clothes and other items donated to charities

- $0.14 per mile to and from a charity where you volunteer

- Will need to itemize on tax return

UNEMPLOYMENT DEDUCTIONS

- Eligible if you looked for a job in present occupation

- Includes resume preparation and employment agency fees

- Most itemize; needs to exceed 2% of adjusted gross income

HEALTH INSURANCE PREMIUMS

- includes long-term premiums based on your age

- Medical expenses must exceed 7.5% of adjusted gross income

- Can deduct 100% if self-employed to extent of net income

HIGHER EDUCATION EXPENSES

- includes tuition and fees, room and board, books, and supplies

- Maximum deduction benefit of up to $4,000

- School should send Form 1098-T for tuition breakdown

INVESTMENT AND TAX EXPENSES

EDUCATOR EXPENSES

- Eligible educators can deduct up to $250

- Includes materials such as books, supplies, and computer equipment

- Expenses must qualify as “ordinary” and “necessary” by IRS

SMART DECISIONS WITH YOUR REFUND

Average refund amount for 2011 filing season $2,913

Most refund checks will go right into savings or paying off debt, but to get your refund to work for you, consider making decisions that will affect next year’s tax return.

How Taxpayers Spend Their Refund

- Savings 43.8%

- Pay Down Debt 39.4%

- Other 5.2%

- Vacation 11.3%

- Major Purchase 12.3%

- Everyday Expenses 28.7%

Super-Charge Your Refund For Next Year

Creating Tax Deductions

Potential Tax Deduction

Charity and Volunteerism

- Donating money and/or used clothes

- volunteering at a non-profit organization

- Adding money roan IRA. SEP. SIMPLE, or solo 401(k) retirement plan. Deduction Benefit Based on individual contributions

Creating Tax Credits

Renewable Energy/ Investment Tax CreditCredit Benefit Potential Tax Credit

- Geothermal heat pump

- Small wind turbines

- Solar Energy Systems

- Fuel Cells

Lifetime Learning Tax Credit Up to $2,000 30% of total development

- Take one or more courses at an eligible educational institution.

- Income must be less than $60,000 or less than 120,000 if married, filing jointly

Learning to be tax smart can save you a little or a lot. Always consult a tax professional for the best advice on how to handle your individual financial situation.

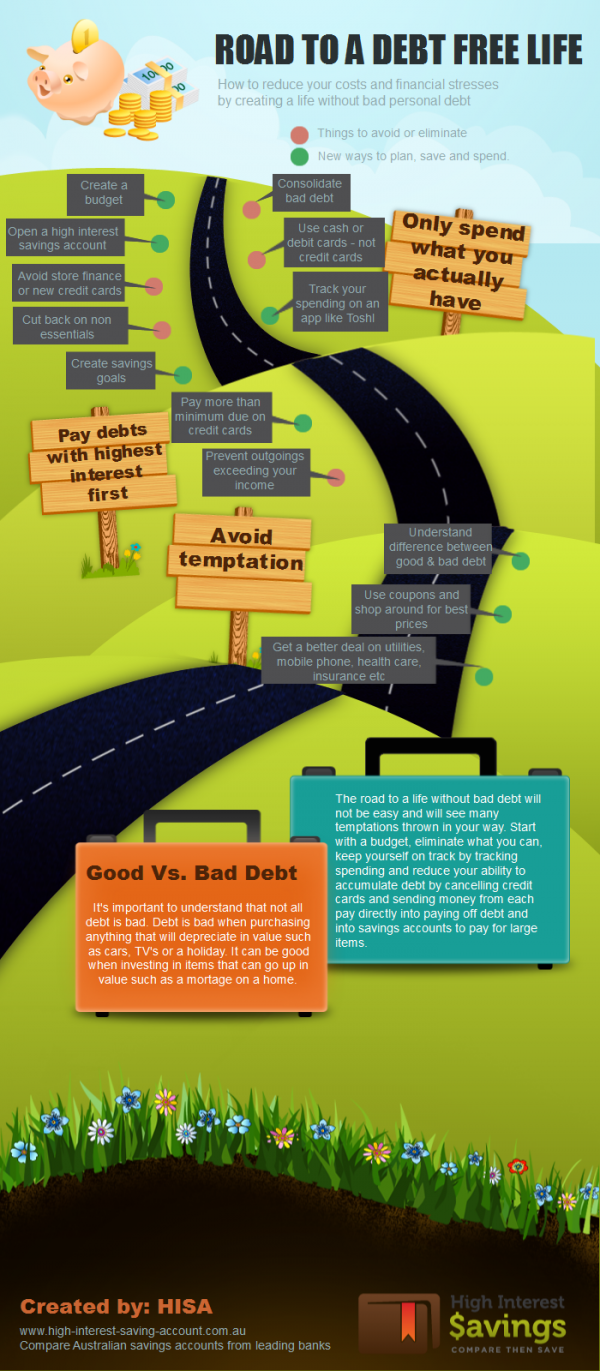

Debt Free for Life – Infographic

on Friday, April 13, 2012

Live Debt Free

Personal finances and money can cause a lot of stress and it is normally due to debt or not enough money to pay for bills and the things you want.

Getting rid of your bad debts and having cash reserves can lead to a simpler, happier life.

Here are five tips to start the road to a debt free life.

1: Create a Budget

The first step to ridding yourself of debt is to get your finances in order with a household budget. Write down everything that you have coming in each month and what you spend on bills, rent or mortgage, eating out, shopping and so on. Try to classify the costs out and look for non-essentials you can cut back on. If you find you have more out goings the incomings then your going to end up in more debt every month.

2: Track Your Spending

It’s hard to figure out exactly where all your money is going when creating a budget using bank statements as a reference. Using a notepad or a mobile phone app such as Toshl spend a few weeks tracking everything you spend. This will save you money by making you think twice before spending and also give you a detailed view of where your money goes so you can find further areas to make cut backs.

To be rid of your bad debt you are going to have to pay off your existing debt and stop creating new debt. Think about doing the following:

* Consolidating credit cards using a balance transfer or using a debt consolidation loan to bring as much of your debt into one place as possible at a lower interest rate.

* If you can’t get all your debt consolidated then focus efforts on the accounts with the highest interest rates first.

* Make room in your budget to pay off as much debt as possible each month.

* Avoid new debt by cutting up your credit cards and switching to debit cards linked directly to the money in your bank accounts.

4: Create a Savings Plan

Make sure you have a savings account with a high interest rate and then create a savings plan with short term and long term goals for items such as holidays, cars and emergency funds for unexpected costs.

5: Avoid Temptation and New Debt

Temptation will be with you all the way along the road so you need to resist it. Avoid taking up new credit, store cards or personal finance loans and try to stick to spending with your own money to enjoy the full benefits of a life without bad debt.

You must be logged in to post a comment.